What to Do with Your Money After a Windfall

Receiving a financial windfall, whether through an inheritance, a significant bonus, a lottery win, or the sale of an asset, can be an exhilarating and life-changing event. The sudden influx of capital often brings with it a potent mix of excitement and apprehension. While the immediate urge might be to indulge in long-held dreams or alleviate pressing financial anxieties, the true wisdom lies in approaching this newfound wealth with a strategic mindset, much like a seasoned investor or a prudent business owner would manage a significant capital injection. Hasty decisions, fueled by emotion rather than logic, are a common pitfall that can quickly dissipate even the most substantial gains.

The very first and arguably most crucial step is to **pause and breathe**. Resist the immediate urge to make any significant financial decisions. Many financial experts advise parking the money in a safe, accessible, yet low-risk account, such as a high-yield savings account or a short-term certificate of deposit, for at least a few months. This “cooling off” period allows the initial euphoria to subside, providing space for clear, rational thought. It also gives you time to thoroughly research your options and avoid the common mistake of impulsive spending or ill-advised investments. Think of it as placing new inventory in a secure warehouse before deciding on the best distribution strategy.

Once the initial excitement settles, the next critical action is to **assemble a trusted team of professionals**. No single individual possesses all the expertise required to navigate the complexities of managing a substantial sum of money. This team should ideally include a fee-only financial advisor (who is legally obligated to act in your best interest), a tax professional (such as a CPA), and potentially an estate planning attorney. These experts can help you understand the tax implications of your windfall, assess your current financial situation comprehensively, and develop a tailored plan that aligns with your long-term goals. Their collective wisdom provides a robust framework, akin to a board of directors guiding a company through a period of significant growth.

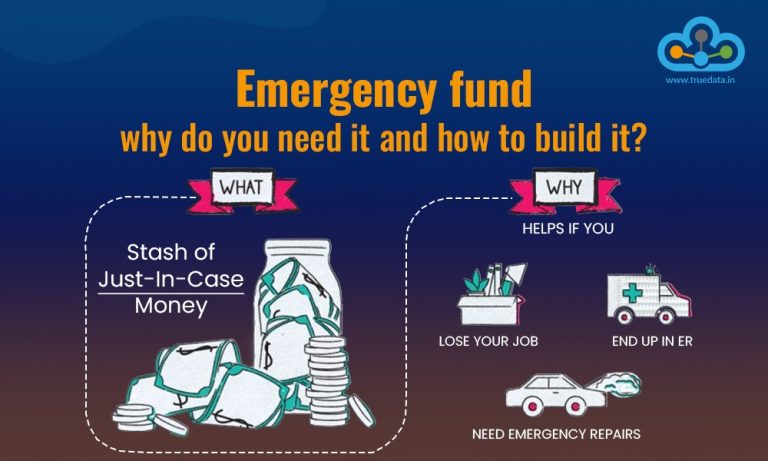

With professional guidance in place, the focus should shift to **addressing existing financial vulnerabilities**. For many, this means tackling high-interest debt. Credit card balances, personal loans, and other forms of expensive debt act as a perpetual drain on your financial resources. Using a portion of your windfall to eliminate these liabilities is often one of the most financially astute moves you can make, as the guaranteed “return” from avoiding high interest payments often outweighs potential investment returns. Beyond debt, establishing or bolstering an emergency fund is paramount. Financial security hinges on having readily accessible funds to cover three to six months (or even more, depending on your personal circumstances) of living expenses. This acts as a crucial buffer against unforeseen challenges, preventing you from having to dip into long-term investments or incur new debt during a crisis.

Following the stabilization of your immediate financial foundation, the conversation turns to **investing for the future**. This is where your long-term financial goals come into sharper focus. Retirement planning often takes precedence; maximizing contributions to tax-advantaged accounts like 401(k)s and IRAs can significantly accelerate your journey toward financial independence. Beyond retirement, consider other significant life goals such as funding a child’s education (through vehicles like 529 plans), making a down payment on a home, or even exploring real estate investments. A diversified investment portfolio, aligned with your risk tolerance and time horizon, is key to growing your wealth sustainably. This phase requires a thoughtful discussion with your financial advisor to construct a strategy that balances growth potential with appropriate risk management, mirroring the careful portfolio management of a large institution.

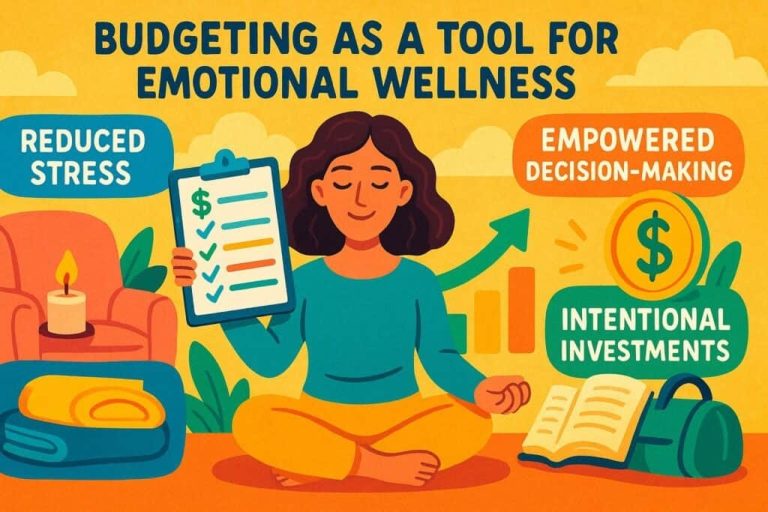

While prudence is key, it’s also important to acknowledge the human desire to **enjoy a portion of your windfall responsibly**. Setting aside a small percentage for a “splurge” can be healthy and affirming, preventing feelings of deprivation. This could be a dream vacation, a meaningful personal purchase, or an investment in yourself through education or skill development. The crucial element here is proportionality; this celebratory spending should be a carefully considered allocation, not an uncontrolled indulgence that jeopardizes your long-term financial well-being. Think of it as a well-deserved bonus for achieving a significant milestone, carefully budgeted to ensure continued financial health.

Finally, remember that managing a windfall is an ongoing process, not a one-time event. Your financial situation, life circumstances, and economic landscape will evolve, necessitating periodic reviews and adjustments to your financial plan. Regularly consult with your financial team to ensure your strategy remains aligned with your goals and that you are maximizing tax efficiencies and investment opportunities. Treating your windfall with respect, diligence, and a long-term perspective can transform it from a fleeting moment of good fortune into a lasting legacy of financial security and freedom.