What Is Parametric Insurance and How Does It Work?

In recent years, the insurance industry has witnessed significant innovation, with one of the most intriguing developments being parametric insurance. Unlike traditional insurance models that rely on assessing actual losses after an event occurs, parametric insurance offers a fundamentally different approach—one that is based on predefined parameters or triggers. This fresh take on risk management has gained attention for its ability to provide quicker payouts and greater transparency, particularly in sectors vulnerable to natural disasters or other predictable risks. Understanding what parametric insurance is and how it works reveals why it is becoming an increasingly attractive option for businesses, governments, and individuals alike.

At its core, parametric insurance is a type of coverage that pays out benefits based on the occurrence of a specific event measured by objective data, rather than on the detailed assessment of damage or loss. These events might include natural catastrophes such as hurricanes, earthquakes, or floods, or even other measurable phenomena like rainfall levels or wind speeds. The key characteristic is that the policy is triggered once a predetermined parameter crosses a set threshold. For example, if a hurricane of category 4 or higher makes landfall within a defined area, the insurance policy automatically disburses a payout without requiring the insured party to file a lengthy claim detailing the exact extent of their damages.

This method contrasts with traditional indemnity insurance, where claims adjusters investigate and verify losses before any payment is made. Indemnity policies often involve lengthy processes, disputes over damage assessments, and delayed compensation. Parametric insurance bypasses these hurdles by focusing on quantifiable metrics collected from trusted sources such as weather stations, satellite data, or seismic sensors. Once the predefined trigger is met, the insurer pays the agreed sum promptly, sometimes within days or even hours. This speed is especially valuable for those who rely on quick access to funds for recovery and rebuilding after disasters.

The appeal of parametric insurance lies not only in its speed but also in its transparency and simplicity. Because payouts are based on clear, objective triggers, both insurers and insured parties have a straightforward understanding of when and why a payment will occur. This clarity reduces ambiguity and potential disputes that often plague traditional claims processes. Moreover, parametric policies can be customized to suit the specific risks faced by different industries or regions, making them highly adaptable. For instance, a farming cooperative in a drought-prone area might purchase a policy that pays out if rainfall drops below a certain level during the growing season, helping to stabilize income despite unpredictable weather patterns.

Despite these advantages, parametric insurance is not without its challenges and limitations. One notable concern is what is known as basis risk—the possibility that the parameter triggering the payout does not perfectly correlate with the actual losses experienced. For example, a hurricane might pass through an area meeting the wind speed threshold but cause less damage than expected, or conversely, significant damage might occur even if the trigger is not met exactly. This mismatch can result in situations where the insured receives a payout that is too high or too low relative to their real losses. To mitigate this, insurers and clients often work closely to design parameters that closely reflect likely damage scenarios, and sometimes parametric policies are combined with traditional coverage to offer more comprehensive protection.

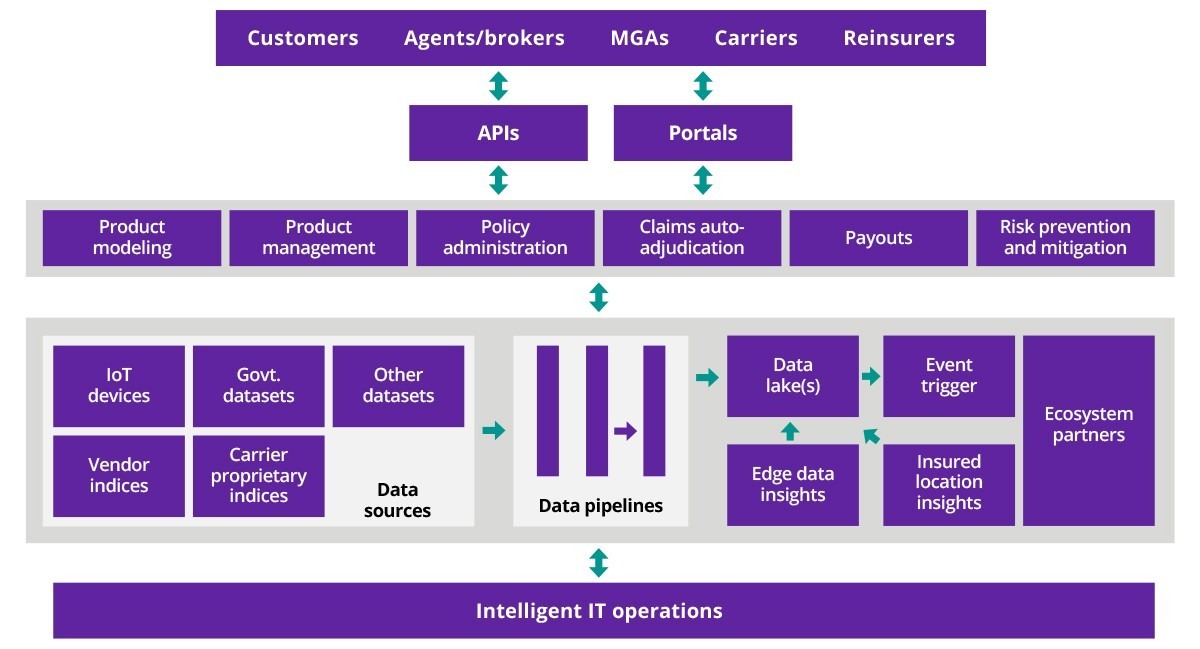

Another aspect to consider is the growing role of technology in enabling parametric insurance. Advances in data collection and analysis, such as satellite imagery, Internet of Things (IoT) sensors, and machine learning, have enhanced the accuracy and reliability of trigger measurements. These technological developments make it possible to monitor risk in real time and tailor insurance solutions more precisely. As data sources become more sophisticated, parametric insurance is likely to expand into new domains, including areas like supply chain risk, renewable energy production, and even pandemic-related economic disruptions.

Practical examples of parametric insurance highlight its growing relevance. In the Caribbean, where hurricanes frequently disrupt economies, parametric insurance schemes have been adopted by governments and regional organizations to provide rapid financial support after storms. These payouts help stabilize economies and fund emergency response efforts without the delays inherent in traditional insurance claims. Similarly, in agriculture, farmers facing unpredictable weather use parametric policies to protect against drought or excessive rainfall, securing essential funds quickly to purchase seeds or equipment for the next planting cycle.

The business world is also recognizing the strategic benefits of parametric insurance. Companies exposed to weather-related risks—such as energy producers, tourism operators, or construction firms—can use these policies to hedge against disruptions and maintain cash flow stability. By reducing uncertainty around disaster-related costs, parametric insurance supports more resilient business planning and investment.

In summary, parametric insurance represents a modern evolution in risk management that capitalizes on objective data and rapid payouts to meet the needs of today’s fast-paced and often unpredictable world. Its unique structure distinguishes it from traditional insurance by focusing on predefined triggers rather than detailed loss assessments. While challenges like basis risk remain, ongoing advancements in technology and data analytics continue to enhance its precision and applicability. For businesses, governments, and individuals seeking innovative ways to manage risk and recover swiftly from adverse events, parametric insurance offers a compelling, transparent, and efficient alternative that is reshaping the insurance landscape.