The Pros and Cons of Paying Off Debt Early

The pursuit of financial freedom often brings with it the compelling question of debt. Specifically, many individuals ponder whether to accelerate their debt repayment, aiming to become debt-free as quickly as possible. While the emotional appeal of shedding financial obligations is undeniable, the decision to pay off debt early is not always a simple one-size-fits-all solution. It involves a nuanced consideration of your financial goals, the types of debt you hold, prevailing interest rates, and your overall financial health.

One of the most significant **pros** of paying off debt early is the substantial **interest savings**. Every dollar you pay above your minimum required payment directly reduces your principal balance, which in turn reduces the amount of interest that accrues over the life of the loan. This is particularly impactful with high-interest debts, such as credit card balances or personal loans. Imagine carrying a credit card balance with an 18% annual interest rate. By aggressively paying it down, you are essentially earning a guaranteed 18% return on your money by avoiding that interest. Over the long term, these savings can amount to thousands, or even tens of thousands, of dollars that would otherwise have gone directly to the lender. This concept is most pronounced with long-term debts like mortgages; even small extra payments early on can shave years off the loan term and dramatically reduce the total interest paid.

Beyond the purely financial aspect, the **peace of mind** that comes with being debt-free is an invaluable benefit. The psychological burden of owing money can be immense, contributing to stress, anxiety, and a feeling of being financially constrained. Eliminating debt can free up mental bandwidth, allowing you to focus on other aspects of your life and financial goals without the constant weight of monthly payments. This newfound financial freedom can also open doors to greater financial flexibility, as the money previously allocated to debt payments can now be redirected towards investing, building an emergency fund, or pursuing other personal aspirations.

From a credit perspective, paying off debt early generally has a **positive impact on your credit score**. While closing an installment loan account might temporarily reduce your credit diversity, the overarching benefit of lowering your debt-to-income ratio and demonstrating responsible financial behavior typically outweighs this minor fluctuation. A lower debt burden signals to future lenders that you are a less risky borrower, potentially leading to better terms on new loans or credit in the future.

However, the decision to accelerate debt repayment is not without its **cons**. One of the primary considerations is the **opportunity cost**. Every dollar used to pay down debt is a dollar that cannot be invested elsewhere. If the interest rate on your debt is low, particularly for a mortgage (which often carries interest rates lower than potential long-term investment returns), you might be better off investing that extra money in a diversified portfolio. For instance, if your mortgage interest rate is 4% and historical stock market returns average 8-10% over the long term, then mathematically, investing the extra funds could lead to greater wealth accumulation over time. This is where the concept of “good debt” (low-interest debt that can help build wealth, like a mortgage) versus “bad debt” (high-interest debt that drains wealth, like credit card debt) comes into play.

Another crucial factor to consider is **prepayment penalties**. Some loan agreements, particularly certain mortgages or personal loans, include clauses that penalize you for paying off the loan ahead of schedule. Lenders impose these fees to compensate for the interest income they lose when a loan is paid off early. Before making any significant extra payments, it is absolutely essential to review your loan documents or contact your lender to determine if such penalties apply and, if so, whether the savings from reduced interest still outweigh these fees.

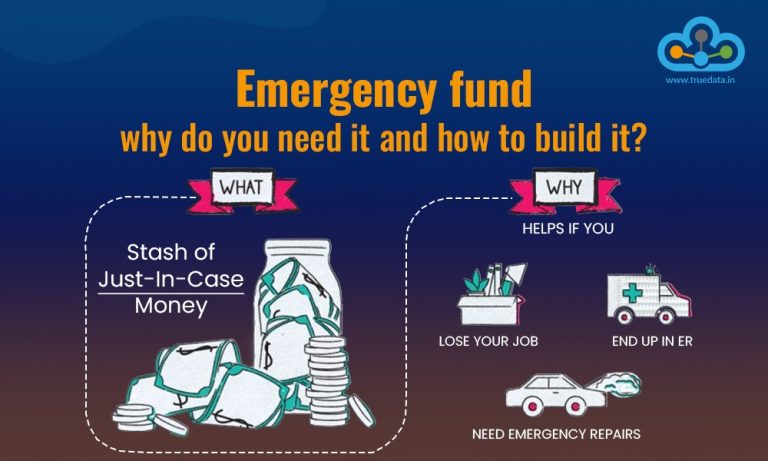

Furthermore, aggressively paying off debt early might **reduce your immediate liquidity**. Diverting large sums of money towards debt repayment could leave you with insufficient funds for unexpected emergencies, potentially forcing you to rely on credit cards or other high-interest loans should an unforeseen expense arise. This underscores the importance of having a robust emergency fund — typically three to six months’ worth of living expenses — in a readily accessible savings account *before* committing significant extra funds to debt repayment. Sacrificing your emergency buffer for debt reduction is a risky strategy that can leave you vulnerable.

Lastly, for certain types of loans, such as student loans, the benefits of early repayment might be less clear-cut. Federal student loans, for example, often come with income-driven repayment plans or forgiveness programs that might make early repayment less financially advantageous for some individuals. The interest on student loans can also be tax-deductible up to a certain amount, further complicating the simple interest-saving calculation.

In conclusion, the decision to pay off debt early is a highly personal one, with valid arguments on both sides. It requires a careful assessment of your unique financial situation, including the interest rates on your debts, your risk tolerance, your emergency savings, and your long-term financial goals. For high-interest consumer debt, the benefits of early repayment almost always outweigh the cons. However, for low-interest debts, especially if you have a stable emergency fund and are comfortable with market fluctuations, investing the extra capital might be a more effective path to building long-term wealth. Ultimately, striking a balance that aligns with your financial priorities and brings you peace of mind is the most prudent approach.