The One Hour Money Makeover

A one hour money makeover might sound ambitious, even unrealistic, but when approached with clarity and purpose, it can be a powerful reset. It’s not about solving every financial challenge in sixty minutes—it’s about creating momentum. Much like a business sprint designed to identify quick wins and set direction, this focused session is about cutting through the noise, assessing your current financial landscape, and making immediate, actionable decisions that set the tone for smarter money management. The goal isn’t perfection; it’s progress.

The first step is to get a snapshot of your financial reality. That means pulling together the essentials—bank balances, credit card statements, loan details, and any recurring expenses. You’re not building a full financial model here; you’re simply laying out the facts. This exercise is similar to a business conducting a rapid audit before a strategy meeting. It’s about visibility. When you see everything in one place, patterns emerge. You might notice that your subscription services have quietly ballooned, or that your grocery spending has crept up over the past few months. These insights aren’t meant to induce guilt—they’re meant to inform decisions.

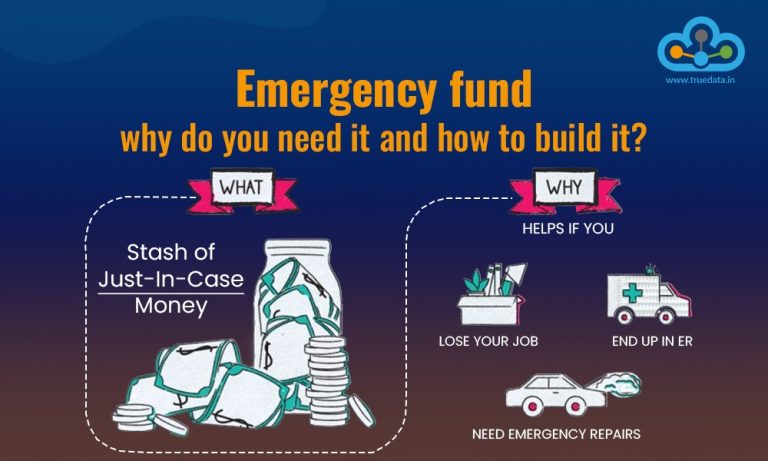

Once you’ve mapped out your financial terrain, the next move is to identify friction points. These are the areas where your money feels misaligned with your values or goals. Maybe you’re paying for a gym membership you haven’t used in months, or you’re carrying a credit card balance despite having savings that could cover it. These mismatches are opportunities. In business, misallocated resources are restructured to improve efficiency. Personally, reallocating funds from low-value expenses to high-impact goals can create immediate relief and long-term benefit. The key is to act decisively. Cancel the unused service. Make the extra payment. Shift the budget. These small moves compound over time.

The one hour makeover also includes a mindset check. Financial stress often stems not just from numbers, but from uncertainty and avoidance. Taking control—even in a short burst—can restore confidence. It’s the same principle that drives agile business practices: short cycles of review and adjustment build resilience. Personally, this means asking yourself what financial success looks like right now. Not in ten years, but today. Is it having a buffer in your account? Reducing debt? Feeling less anxious about bills? Defining a clear, short-term goal helps anchor your decisions and gives your actions immediate relevance.

Technology can be a helpful ally in this process. Setting up alerts for low balances, automating savings transfers, or using a budgeting app to categorize spending can streamline your financial life. But the tools are only as effective as the intention behind them. In business, software supports strategy—it doesn’t replace it. Personally, the same applies. Use technology to reduce friction, not to avoid engagement. The one hour makeover is about reconnecting with your money, not outsourcing responsibility.

Communication is another layer worth considering, especially if you share financial responsibilities with a partner or family member. A quick check-in about shared goals, upcoming expenses, or recent changes can prevent misunderstandings and foster collaboration. In business, financial transparency strengthens teams and aligns stakeholders. At home, it builds trust and reduces stress. Even a brief conversation can clarify expectations and reinforce shared commitment to financial health.

The final piece of the makeover is setting a follow-up. One hour won’t solve everything, but it can set the stage for ongoing improvement. Scheduling a monthly review, setting a calendar reminder to revisit goals, or committing to a weekly budget check-in keeps the momentum going. In business, recurring financial reviews are standard practice. Personally, they should be too. The goal is to make financial awareness a habit, not a one-time event.

Ultimately, the one hour money makeover is about reclaiming agency. It’s about stepping out of autopilot and making intentional choices. It’s not a deep dive—it’s a reset. And like any good strategy session, its power lies in clarity, focus, and execution. When you take even a short amount of time to engage with your finances, you shift the narrative from stress to strategy. You begin to see money not as a source of anxiety, but as a tool for building the life you want. That shift, even if it starts in just one hour, can change everything.