Insurance Apps That Make Your Life Easier

In an era defined by instant gratification and seamless digital interactions, the insurance industry, often perceived as traditional and slow-moving, has embarked on a remarkable transformation. At the heart of this evolution are mobile applications, rapidly becoming indispensable tools that empower policyholders and fundamentally reshape the customer experience. No longer are individuals tethered to lengthy phone calls, mountains of paperwork, or inconvenient in-person visits to manage their insurance needs. Today, a world of convenience, transparency, and efficiency resides quite literally in the palm of their hand.

The primary appeal of insurance apps lies in their ability to centralize and simplify complex processes. Consider the sheer volume of information associated with even a single insurance policy: coverage limits, deductibles, premium due dates, policy documents, and contact details. Traditionally, accessing this information might have involved rummaging through physical folders or navigating labyrinthine customer service menus. Now, a few taps on a smartphone can bring up all relevant policy details instantly. This 24/7 access to information is invaluable, offering peace of mind and enabling swift action, whether it’s confirming coverage at the roadside after a minor incident or reviewing health insurance benefits before a doctor’s appointment.

Beyond mere information retrieval, these applications have truly revolutionized the claims process, often the most stressful interaction a policyholder has with their insurer. What was once a protracted ordeal of phone calls, detailed descriptions, and mailed documents has been streamlined into an intuitive digital workflow. Imagine a scenario where a motorist experiences a minor fender bender. Instead of waiting for an adjuster or returning home to fill out forms, they can now use their insurer’s app directly at the scene. They can capture geotagged photos and videos of the damage, record voice notes about the incident, gather witness information, and even initiate the First Notice of Loss (FNOL) immediately. Some advanced apps even leverage AI to analyze the submitted visuals, providing preliminary damage assessments and repair estimates on the spot. This not only significantly accelerates the claims resolution time but also reduces the emotional burden on the claimant during a potentially stressful situation.

Furthermore, managing payments and renewals has become remarkably effortless through insurance apps. Policyholders can receive timely reminders for upcoming premium due dates, set up automated payments, and make one-off payments securely with just a few clicks. This digital convenience helps prevent policy lapses due to forgotten payments, ensuring continuous coverage and mitigating unnecessary risks. The transparency offered by these apps extends to providing clear payment histories and detailed breakdowns of charges, fostering greater trust between the insurer and the insured.

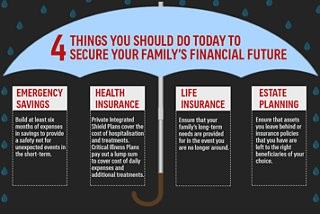

Many insurance apps also go beyond basic policy management to offer proactive tools that genuinely simplify daily life and even encourage safer habits. For instance, telematics-based auto insurance apps use smartphone sensors or in-car devices to monitor driving behavior, such as speed, braking, and cornering. Good driving habits can lead to personalized discounts on premiums, incentivizing safer roads for everyone. Similarly, some health insurance apps integrate with wearable fitness trackers, offering rewards or reduced premiums for meeting wellness goals. For homeowners, certain apps might provide smart home integrations, offering alerts for potential issues like water leaks or extreme weather, potentially preventing costly damages before they escalate. This shift from purely reactive coverage to proactive risk mitigation and incentivization is a significant leap forward.

The digital interaction offered by these apps also opens up new avenues for personalized communication and support. Integrated chatbots, often powered by artificial intelligence, can answer frequently asked questions instantly, guide users through processes, and even help resolve minor issues around the clock. For more complex queries, the apps typically provide direct access to customer service representatives via chat or call, minimizing wait times and ensuring that help is always just a tap away. This enhanced accessibility and responsive support contribute significantly to improved customer satisfaction and loyalty.

Looking ahead, the evolution of insurance apps is far from over. We can anticipate even greater personalization, with AI-driven recommendations for tailored coverage based on individual lifestyle, evolving needs, and predicted risks. The integration with broader digital ecosystems, such as smart homes, connected vehicles, and health platforms, will continue to deepen, allowing for more holistic risk management and seamlessly embedded insurance products. Imagine purchasing a new travel booking, and the necessary travel insurance is automatically offered and can be activated with a single confirmation within the same app. This frictionless experience is the future.

In essence, insurance apps are transforming what was once a largely transactional and often cumbersome relationship into a more engaging, transparent, and user-centric experience. They are not merely digital versions of old processes; they are fundamental reimaginations, leveraging technology to empower policyholders, simplify their lives, and foster a more proactive approach to managing their risks. For both insurers and their customers, these innovative applications are proving to be an indispensable tool in navigating the complexities of modern life with greater ease and confidence.