How to Save for Your First Home Without Sacrificing Fun

The dream of homeownership, for many, remains a cornerstone of financial aspiration and personal stability. Yet, the path to acquiring that first home often feels like a formidable climb, particularly when confronted with the seemingly insurmountable hurdle of accumulating a substantial down payment. The prevailing wisdom often suggests a drastic, almost monastic, curtailment of all discretionary spending, turning the saving process into a joyless exercise in deprivation. However, this all-or-nothing approach is not only unsustainable for most but can also lead to burnout and a complete abandonment of the goal. The true art of saving for your first home without sacrificing all the fun lies in a balanced, strategic approach that integrates financial discipline with a realistic appreciation for life’s enjoyable moments.

One of the most crucial initial steps is to gain absolute clarity on your homeownership goal. This means researching realistic home prices in your desired area and understanding the typical down payment required, which often ranges from 3% to 20% of the home’s value. Once you have a concrete target sum, work backward to determine a realistic timeline for saving. This clear vision transforms an abstract dream into a tangible financial objective. For instance, if you need $50,000 for a down payment in three years, you know you need to save approximately $1,389 per month. This specificity is empowering, as it provides a quantifiable benchmark against which you can track your progress.

With your saving target in mind, the next vital move is to scrutinize your current spending habits without immediately resorting to extreme cuts. The aim here is not to eliminate all discretionary spending, but to identify areas where subtle adjustments can yield significant savings over time. Start by tracking every dollar you spend for a month or two. This can be an eye-opening exercise, revealing where your money is truly going. You might discover, for example, that daily coffee runs, frequent takeout meals, or numerous unused subscriptions are collectively draining hundreds of dollars each month. These aren’t necessarily “bad” expenses, but they represent opportunities for thoughtful re-prioritization.

Once you have a clear picture of your spending, you can strategically allocate funds. Rather than adopting an “everything goes” mentality, identify a few key areas where you can make impactful, yet tolerable, reductions. Perhaps it means brewing coffee at home on weekdays and treating yourself to a cafe visit only on weekends. Maybe it’s cooking at home more often and reserving restaurant outings for special occasions. The goal is to find a balance where you still enjoy life but are consciously redirecting a portion of those discretionary dollars towards your home fund. This approach feels less like punishment and more like a conscious choice to invest in your future.

A powerful psychological hack for saving without feeling deprived is to automate your contributions. Set up a recurring, automatic transfer from your checking account to a dedicated savings account specifically for your down payment, ideally one that offers a high-yield interest rate. Schedule this transfer to occur on your payday, treating it like a non-negotiable bill. When money is moved automatically before you even have a chance to spend it, you “pay yourself first” and are less likely to miss the funds. This consistent, hands-off approach ensures steady progress and reduces the need for constant willpower.

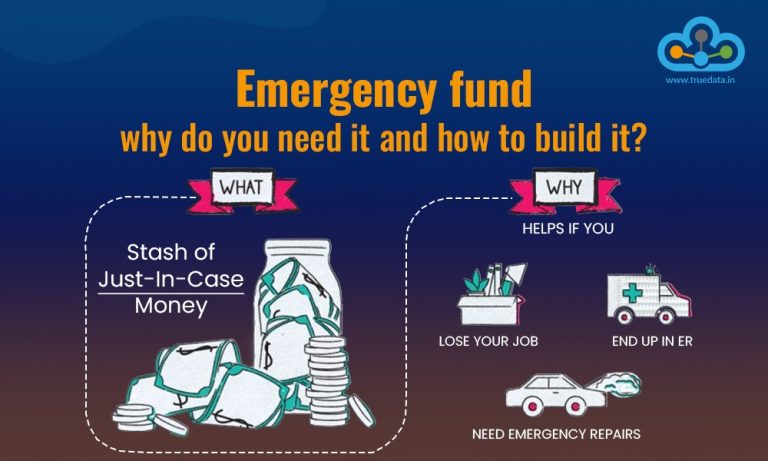

Furthermore, explore opportunities to boost your income or find “found money” that can accelerate your savings without impacting your current lifestyle. This could involve taking on a side hustle for a few hours a week, selling unused items around your home, or directing work bonuses, tax refunds, or unexpected gifts directly into your down payment fund. Even small increments from these additional sources can add up quickly, shortening your savings timeline and allowing you to maintain more of your regular spending on enjoyable activities. Think of these as “bonus” savings that don’t require you to cut into your existing fun budget.

The key to long-term success in this endeavor is sustainability. An overly restrictive budget is prone to failure because it creates resentment and eventually leads to abandonment. Instead, build in a “fun fund” within your budget – a specific amount of money allocated each month purely for entertainment, hobbies, or social outings. This designated fund ensures that you don’t feel entirely deprived, allowing you to enjoy life’s pleasures while still making significant progress towards your homeownership dream. It’s about conscious spending, not complete abstinence. Knowing you have a budget for fun prevents guilt and helps you appreciate the experiences you choose.

Finally, communicate your goals with trusted friends and family. Having a support system can provide encouragement and accountability. They might even suggest fun, low-cost activities that align with your savings goals, or they may understand if you occasionally opt out of expensive outings. Celebrating milestones, no matter how small, along your saving journey can also provide powerful motivation. Reaching your first $5,000 or completing your first year of consistent saving are significant achievements that deserve recognition, reinforcing the positive habits you’re building.

In conclusion, saving for your first home doesn’t have to entail a monastic existence devoid of joy. By embracing a strategic approach that includes clearly defining your target, meticulously tracking spending for conscious adjustments, automating contributions, seeking opportunities for additional income, and importantly, building a dedicated “fun fund” into your budget, you can progress steadily towards homeownership. It’s a balanced act of discipline and enjoyment, demonstrating that financial responsibility and a fulfilling lifestyle are not mutually exclusive but can, in fact, coexist beautifully on the path to your dream home.