How to Make Insurance Feel More Human-Centered

Insurance has traditionally been viewed as a transactional necessity—something people purchase out of obligation rather than enthusiasm. It’s often associated with paperwork, fine print, and impersonal processes. But as consumer expectations evolve and emotional intelligence becomes a competitive advantage, the insurance industry faces a compelling opportunity: to become more human-centered. This shift isn’t just about improving customer service or streamlining claims. It’s about reimagining the entire experience to reflect empathy, clarity, and genuine care.

Making insurance feel more human-centered begins with understanding the emotional context in which it operates. People don’t engage with insurance because they want to—they do it because they need to. Whether it’s protecting a home, securing health coverage, or planning for unexpected loss, insurance touches some of life’s most vulnerable moments. A human-centered approach recognizes this and responds with sensitivity. It means designing interactions that feel supportive rather than transactional, and creating systems that prioritize emotional well-being alongside financial protection.

Communication is one of the most powerful tools in this transformation. Too often, insurance language is dense, technical, and intimidating. Customers are left feeling confused or overwhelmed, unsure of what they’ve signed up for or how to use it. Human-centered insurance speaks clearly and respectfully. It uses plain language, visual aids, and real-world examples to explain coverage, exclusions, and processes. It anticipates questions and offers answers before they’re asked. This kind of communication doesn’t just inform—it reassures. It builds trust by making people feel understood and respected.

Technology can enhance this experience when used with empathy. Digital platforms offer convenience, but they must also offer connection. A well-designed app or website should feel intuitive, responsive, and emotionally intelligent. It should guide users through complex decisions with clarity and care. For example, a claims portal that offers step-by-step instructions, real-time updates, and empathetic messaging can turn a stressful situation into a manageable one. The goal isn’t just to automate—it’s to humanize. Technology should support people, not replace them.

Customer service is another critical touchpoint. When someone reaches out to their insurer, they’re often in a moment of stress or uncertainty. The way that interaction unfolds can shape their entire perception of the brand. Human-centered service is not just about solving problems—it’s about showing up with compassion. It means training representatives to listen actively, respond thoughtfully, and follow through reliably. It means creating systems that empower employees to act with empathy rather than rigidly following scripts. When people feel genuinely cared for, they’re more likely to trust and stay loyal.

Designing for inclusivity is also essential. Insurance must serve diverse populations with different needs, backgrounds, and experiences. A human-centered approach asks who might be excluded or underserved and works to bring them in. This could mean offering multilingual support, designing accessible interfaces, or tailoring products to reflect cultural nuances. It’s about recognizing that one-size-fits-all doesn’t work in a world full of unique individuals. Inclusivity isn’t just a moral imperative—it’s a strategic one. It expands reach, deepens engagement, and builds stronger communities.

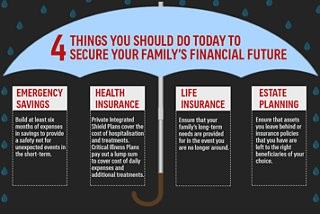

Education plays a vital role in making insurance more human-centered. Many people feel intimidated by insurance simply because they’ve never been taught how it works. They don’t know what questions to ask, what coverage they need, or how to navigate claims. When insurers invest in education—through workshops, content, or personalized consultations—they empower customers to make informed decisions. This empowerment reduces anxiety and builds confidence. It turns passive consumers into active participants. And that shift is at the heart of a human-centered experience.

Internally, insurers must also cultivate a culture that reflects these values. Employees who feel supported, valued, and aligned with the company’s mission are more likely to deliver empathetic service. This means investing in training, creating space for feedback, and fostering a sense of purpose. When the internal culture is human-centered, the external experience naturally follows. Customers can sense when a company genuinely cares—and that care begins behind the scenes.

Ultimately, making insurance feel more human-centered is about shifting the narrative. It’s about moving from obligation to empowerment, from confusion to clarity, and from transaction to relationship. It’s about designing every aspect of the business—from products to processes to people—with the intention of supporting, uplifting, and understanding. Insurance doesn’t have to be cold or complicated. It can be warm, clear, and deeply human. And when it is, it becomes not just a product, but a promise—a promise that people can rely on, feel good about, and trust in the moments that matter most.