How to Insure Your GitOps Strategy

GitOps has quickly become one of the most influential approaches to managing modern infrastructure and application deployments. By using Git as the single source of truth, organizations gain a powerful way to automate, audit, and scale their operations. Yet, as with any strategy that touches critical systems, GitOps is not immune to risk. Insuring your GitOps strategy means building resilience into the processes, tools, and culture that support it, ensuring that automation enhances reliability rather than introducing vulnerabilities.

The foundation of GitOps lies in the principle that everything is declared in code and stored in version control. This creates transparency and traceability, but it also means that mistakes in configuration files or deployment manifests can have immediate and far-reaching consequences. Insuring against these risks requires safeguards that catch errors before they reach production. Automated validation pipelines, peer reviews, and policy enforcement tools act as protective layers, ensuring that changes are not only fast but also safe. This insurance transforms GitOps from a bold experiment into a dependable operational model.

One of the most important aspects of insuring GitOps is securing the Git repositories themselves. These repositories hold the keys to infrastructure and applications, making them prime targets for attackers. Strong access controls, encryption, and monitoring are essential to protect against unauthorized changes. By treating repositories as critical assets, organizations insure themselves against breaches that could compromise entire environments. This mindset elevates Git from a simple version control system to a cornerstone of operational security.

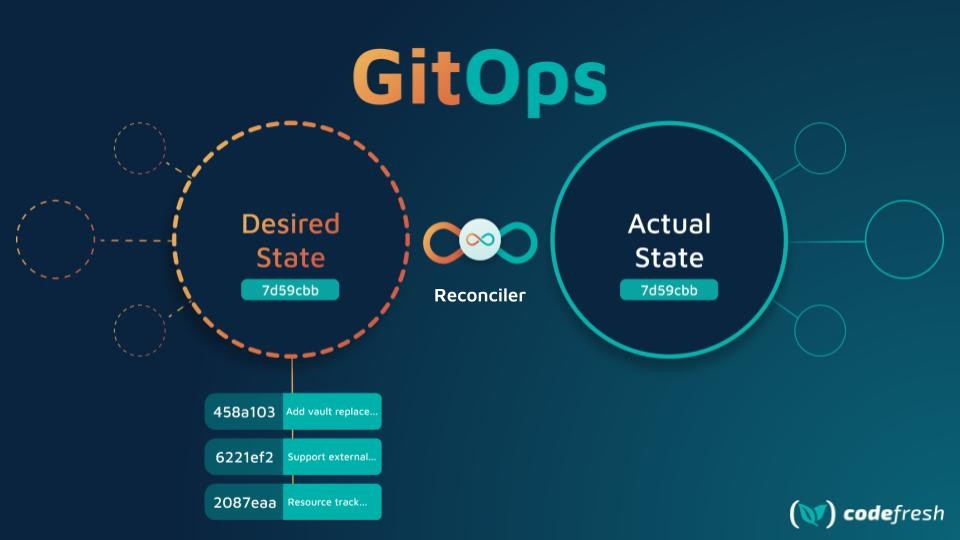

Resilience in GitOps also depends on the reliability of automation tools. Continuous deployment agents, reconciliation loops, and monitoring systems must function consistently to ensure that declared states match actual states. If these tools fail, the GitOps model can break down, leaving systems in an inconsistent or vulnerable state. Insuring against this involves redundancy, failover mechanisms, and regular testing of automation workflows. By validating that tools perform as expected under stress, organizations create confidence that GitOps will hold up even in challenging conditions.

Human factors play a significant role in insuring GitOps strategies. While automation reduces manual intervention, people are still responsible for writing configurations, approving changes, and managing policies. Training teams to understand GitOps principles and encouraging a culture of accountability insures against errors born of misunderstanding or neglect. When developers and operators share a common language and approach, the likelihood of misaligned expectations decreases. This cultural insurance is as important as technical safeguards in sustaining the reliability of GitOps.

Documentation is another critical element of insurance. GitOps thrives on declarative definitions, but without clear documentation, teams may struggle to understand the rationale behind certain configurations or workflows. Documenting processes, policies, and decision-making ensures that knowledge is not lost when individuals move on. It insures the organization against gaps in institutional memory, making GitOps strategies more sustainable over time. Documentation also reinforces transparency, which is one of the core values of GitOps itself.

Compliance and regulatory requirements add another dimension to insuring GitOps. In industries where audits and accountability are mandatory, GitOps provides a natural advantage by maintaining a clear record of changes. However, organizations must ensure that their GitOps practices align with regulatory standards. This means insuring against gaps in audit trails, ensuring that approvals are properly documented, and validating that configurations meet compliance requirements. By integrating compliance into GitOps workflows, organizations protect themselves from legal and reputational risks.

Financial considerations also highlight the importance of insurance in GitOps. Outages caused by misconfigurations or failed deployments can lead to lost revenue, missed opportunities, and strained customer relationships. Insuring GitOps means quantifying these risks and investing in measures that reduce the likelihood of costly disruptions. Disaster recovery plans, rollback mechanisms, and backup strategies ensure that even when failures occur, recovery is swift. This financial insurance aligns technical practices with business priorities, reinforcing the idea that resilience is not just a technical goal but a strategic necessity.

Vendor dependencies further illustrate the need for insurance. Many organizations rely on managed Git platforms, cloud providers, or third-party tools to support their GitOps workflows. If a vendor experiences downtime or changes its policies, the impact can ripple through the organization. Insuring against these risks involves evaluating vendor reliability, negotiating service-level agreements, and building resilience into integrations. This ensures that external disruptions do not cascade into internal failures, protecting the organization from risks beyond its direct control.

Psychological assurance is another subtle but important benefit of insuring GitOps. Teams that know safeguards are in place can work with greater confidence. Instead of worrying about catastrophic failures, they can focus on innovation and growth. This peace of mind is a form of insurance that empowers organizations to embrace GitOps fully, knowing that risks are managed and mitigated. It highlights the human dimension of resilience, where assurance fosters productivity and creativity.

Ultimately, insuring your GitOps strategy is about resilience. It acknowledges that automation, while powerful, is not infallible. By combining technical safeguards, cultural practices, documentation, and compliance, organizations create a framework that transforms GitOps from a fragile experiment into a robust operational model. This holistic approach ensures that GitOps continues to support business goals even in the face of uncertainty.

As businesses become more reliant on cloud-native infrastructure and continuous delivery, the importance of insuring GitOps strategies will only grow. They are the engines of modern operations, and their reliability is essential to digital success. By treating GitOps as an asset that requires protection, organizations position themselves to thrive in a world where agility and resilience are inseparable. Insurance for GitOps is not just about preventing failure; it is about enabling confidence, continuity, and sustainable growth in the digital age.