How to Build an Emergency Fund Step-by-Step

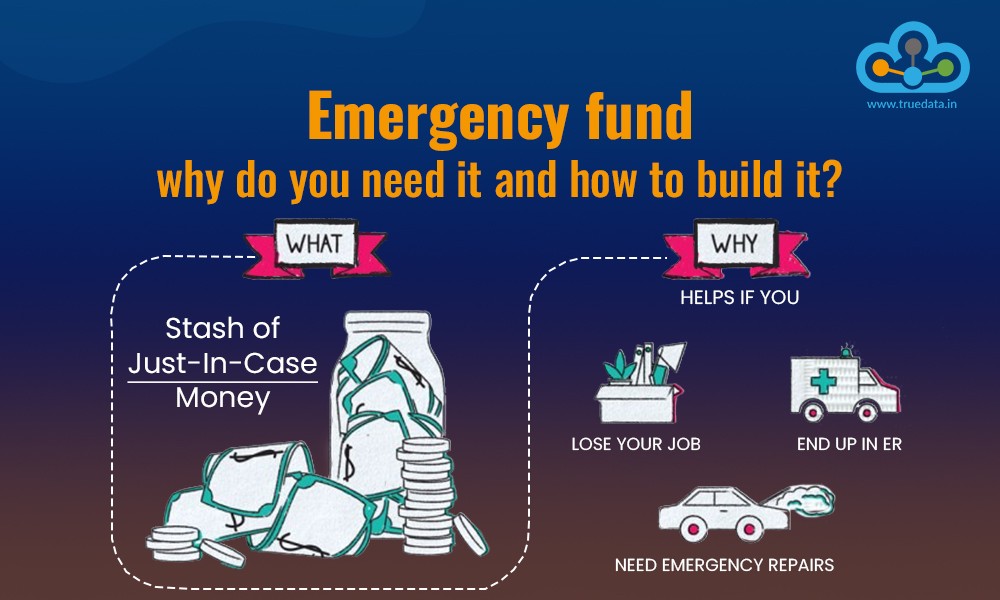

In the often unpredictable journey of life, unforeseen challenges inevitably arise. Whether it’s an unexpected job loss, a sudden medical emergency, a major car repair, or a home maintenance crisis, these events can quickly derail even the most carefully constructed financial plans. It is precisely in these moments that the immense value of an emergency fund becomes unequivocally clear. Far from being a luxury, an emergency fund is a foundational pillar of financial security, acting as a crucial buffer against life’s inevitable curveballs. Building this vital financial cushion is a systematic process, achievable for anyone committed to taking control of their financial future.

The initial step in establishing a robust emergency fund involves defining its purpose and setting a realistic target. An emergency fund is not for a new gadget, a vacation, or a down payment on a house; its sole purpose is to cover essential living expenses during unforeseen crises. The widely recommended target is to save enough to cover three to six months’ worth of necessary expenses. For a self-employed individual or someone with an unstable income, aiming for six to twelve months might be more prudent. To determine your personal target, meticulously calculate your monthly essential expenditures—rent/mortgage, utilities, groceries, transportation, insurance premiums, and minimum debt payments. Exclude discretionary spending like dining out or entertainment. Once you have this baseline figure, multiply it by your desired number of months to arrive at your specific savings goal. This clear, quantifiable target transforms a vague aspiration into a concrete objective.

With a clear target in mind, the next crucial step is to integrate saving into your budget as a non-negotiable priority. Too often, saving is treated as an afterthought—money left over at the end of the month. This approach rarely yields substantial results. Instead, adopt the “pay yourself first” philosophy. As soon as you receive your paycheck, automate a transfer of a predetermined amount directly into your emergency fund savings account. Treating this contribution as a fixed expense, much like your rent or utility bill, ensures consistency and discipline. Even starting with a modest amount, such as ฿500 or ฿1,000 per week or month, can build momentum and demonstrate progress, reinforcing the habit. This automation removes the temptation to spend the money and capitalizes on behavioral economics to support your financial goals.

The location of your emergency fund is almost as important as its existence. This money should be held in a separate, easily accessible, yet distinct account from your everyday checking account. A high-yield savings account is typically the ideal choice. It offers liquidity, meaning you can access the funds quickly if needed, while also earning a modest amount of interest, allowing your money to grow slightly over time. Crucially, keeping it separate from your operational funds reduces the temptation to dip into it for non-emergencies. The psychological barrier of transferring money from a dedicated emergency account makes you think twice before spending it on something that isn’t truly an emergency.

To accelerate the growth of your emergency fund, consider actively seeking opportunities to boost your savings rate. This might involve temporarily cutting back on non-essential spending, such as dining out less frequently, pausing subscriptions you rarely use, or finding more cost-effective entertainment options. Beyond cutting expenses, look for ways to increase your income. This could include taking on a side hustle, selling unused items, or redirecting bonuses or tax refunds directly into your emergency fund. Every extra baht contributed gets you closer to your goal faster, building momentum and psychological satisfaction. This proactive approach accelerates the buffer building, offering peace of mind sooner.

Finally, and perhaps most critically, once your emergency fund is established, it requires ongoing maintenance and discipline. The temptation to “borrow” from it for non-emergencies can be strong, especially for appealing discretionary purchases. Remind yourself of the fund’s sole purpose: a safety net for genuine crises. If you do need to use a portion of the fund for an actual emergency, make it an immediate priority to replenish it. This commitment to rebuilding ensures that your financial safety net remains intact and ready for future unforeseen events. Regularly review your emergency fund balance against your current essential expenses, adjusting your target if your living costs change.

Building an emergency fund is a tangible demonstration of financial foresight and responsibility. It provides a profound sense of security, reduces financial stress, and prevents unexpected setbacks from spiraling into debilitating debt. While the initial steps might require discipline and sacrifice, the peace of mind and resilience gained from having this crucial financial buffer are invaluable, empowering you to navigate life’s uncertainties with confidence and stability.