How to Be Financially Confident

Financial confidence isn’t about having all the answers or reaching a certain income level—it’s about feeling secure in your ability to make informed decisions, adapt to change, and pursue your goals with clarity. It’s the quiet assurance that you’re in control of your financial life, even when circumstances shift. Many people assume confidence comes after success, but in reality, it’s built through consistent habits, thoughtful planning, and a mindset that embraces learning and growth. When you cultivate financial confidence, you don’t just manage money—you shape your future with intention.

The foundation of financial confidence begins with understanding. You can’t feel confident about something you don’t fully grasp. That means taking the time to learn the basics—how your income flows, where your money goes, what your obligations are, and how your choices impact your long-term stability. This doesn’t require a finance degree or hours of study. It starts with simple awareness. For example, regularly reviewing your bank statements or tracking your spending can reveal patterns that help you make better decisions. When you know your numbers, you gain clarity. And clarity is the antidote to anxiety.

Confidence also grows from consistency. It’s not the big, dramatic moves that build financial strength—it’s the small, repeated actions. Saving a portion of your income, paying bills on time, contributing to retirement, and avoiding unnecessary debt are all habits that reinforce control. Over time, these behaviors compound, creating a sense of progress and reliability. For instance, someone who sets up automatic transfers to savings each month may not notice the impact immediately, but after a year, they’ll see a cushion that offers peace of mind. That visible progress reinforces the belief that they’re capable and on track.

Another key element is adaptability. Financial confidence doesn’t mean everything goes according to plan—it means you’re prepared to respond when it doesn’t. Life is unpredictable, and the ability to pivot without panic is a hallmark of true confidence. That might involve adjusting your budget after a job change, rethinking your goals after a major expense, or exploring new income sources when needed. Flexibility isn’t a sign of weakness—it’s a strength. For example, someone who loses a job but has an emergency fund and a side hustle in place can navigate the transition with far less stress. Their preparation gives them options, and options build confidence.

Mindset plays a powerful role as well. Many people struggle with financial insecurity not because of their actual situation, but because of how they perceive it. Fear, shame, and comparison can erode confidence, even when the numbers are solid. Shifting your mindset from scarcity to possibility changes the way you approach money. Instead of focusing on limitations, you begin to see opportunities. For instance, viewing a tight budget as a creative challenge rather than a punishment can lead to smarter choices and a greater sense of control. Confidence isn’t just about what you have—it’s about how you think.

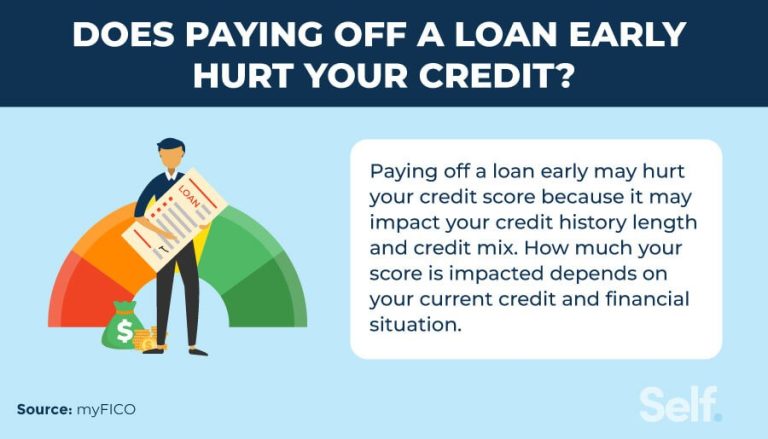

Education is another pillar of financial confidence. The more you understand, the more empowered you become. That doesn’t mean memorizing jargon or mastering complex strategies—it means staying curious and informed. Reading articles, listening to podcasts, or attending workshops can deepen your knowledge and expose you to new ideas. For example, learning about compound interest might inspire you to start investing earlier, while understanding credit scores can help you improve your financial standing. Education turns uncertainty into insight, and insight fuels confidence.

Communication also matters, especially if your financial life is shared with others. Being able to talk openly about money—with a partner, advisor, or even a friend—creates transparency and trust. It allows you to align on goals, address concerns, and make decisions collaboratively. For instance, a couple who regularly discusses their budget and savings plan is more likely to feel secure and united than one who avoids the topic. Confidence grows in environments where money isn’t taboo but treated as a shared responsibility and a tool for achieving what matters.

It’s important to recognize that financial confidence is not a destination—it’s a practice. It evolves as your life changes, and it requires regular attention. You might feel confident in one area, like budgeting, but uncertain in another, like investing. That’s normal. The goal isn’t perfection—it’s progress. By continuing to engage with your finances, ask questions, and refine your approach, you build a foundation that supports both stability and growth. For example, someone who starts with basic budgeting might later explore real estate or entrepreneurship, expanding their confidence as their experience grows.

Ultimately, being financially confident means trusting yourself. It means knowing that you’re capable of making good decisions, learning from mistakes, and adapting when needed. It’s not about having more—it’s about doing more with what you have. When you cultivate that trust, you stop reacting to money with fear and start engaging with it from a place of strength. You become the architect of your financial life, not just a passenger. And in that shift, you unlock not just financial success, but personal freedom.