Why Insurance Is a Form of Strategic Thinking

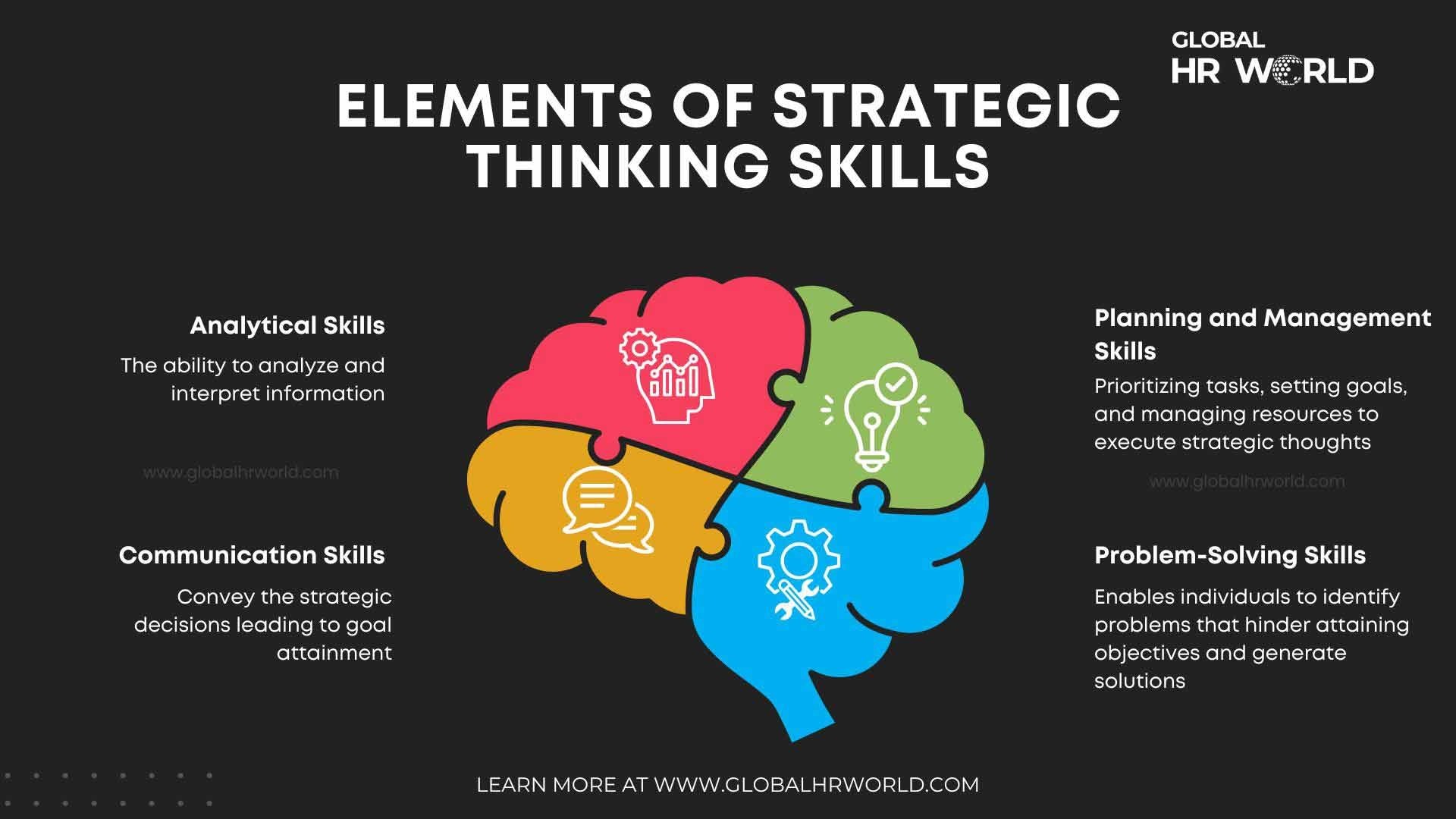

Strategic thinking is often associated with bold moves, long-term planning, and the ability to anticipate future challenges. It’s the mindset that drives innovation, guides investment decisions, and shapes the trajectory of businesses and personal lives alike. Yet one of the most overlooked expressions of strategic thinking is insurance. While it may seem like a routine financial product, insurance is, in fact, a deliberate and forward-looking tool that reflects a deep understanding of risk, resilience, and resource allocation. Choosing to insure is not just about protection—it’s about positioning yourself to thrive in an unpredictable world.

At its essence, strategic thinking involves preparing for multiple outcomes. It’s not just about hoping for the best but planning for the worst while still enabling the best to unfold. Insurance fits squarely into this framework. It allows individuals and organizations to safeguard against losses that could derail progress, while freeing up mental and financial bandwidth to pursue growth. For example, a business that carries comprehensive liability coverage can confidently enter new markets or launch new products, knowing that unforeseen legal issues won’t jeopardize its core operations. That confidence isn’t accidental—it’s the result of strategic foresight.

Insurance also reflects an understanding of opportunity cost. Every dollar spent on coverage is a dollar not spent elsewhere, which means the decision to insure must be weighed against potential alternatives. Strategic thinkers recognize that the cost of not insuring—of being exposed to catastrophic loss—is often far greater than the premium paid. Consider a homeowner who chooses to forgo flood insurance because their area hasn’t flooded in decades. If a rare storm hits, the financial damage could be devastating. The strategic thinker doesn’t rely on past luck; they assess probabilities, evaluate impact, and make decisions that protect long-term value.

In the realm of personal finance, insurance supports strategic goals by preserving capital and enabling continuity. Life insurance, for instance, ensures that dependents can maintain their lifestyle and pursue their aspirations even in the absence of a primary earner. Disability insurance protects income streams, allowing individuals to recover from illness or injury without derailing their financial plans. These forms of coverage are not reactive—they’re proactive. They reflect a commitment to stability and a recognition that setbacks, while unpredictable, are inevitable. Strategic thinkers don’t just build wealth—they protect it.

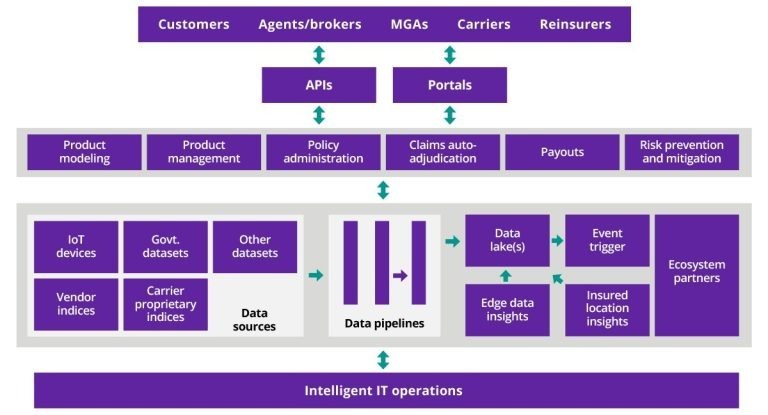

For businesses, insurance is integral to risk management, which is itself a cornerstone of strategic planning. Companies face a wide array of risks—operational, financial, reputational, and environmental. Insurance helps quantify and transfer those risks, allowing leaders to focus on execution rather than contingency. A manufacturer with property and business interruption insurance can recover quickly from a fire or supply chain disruption. A tech firm with cyber liability coverage can respond decisively to a data breach. These capabilities are not just about survival—they’re about maintaining momentum and preserving strategic advantage.

Insurance also plays a role in enabling innovation. Risk is inherent in experimentation, and without a safety net, organizations may shy away from bold initiatives. By insuring against potential losses, companies can take calculated risks that drive progress. A startup might invest in a new product line, knowing that its assets are protected. A nonprofit might launch a community program, confident that its liability exposure is covered. In each case, insurance supports strategic thinking by reducing the fear of failure and encouraging action.

The strategic value of insurance extends to reputation and stakeholder trust. Clients, investors, and partners expect organizations to be prepared. Carrying appropriate coverage signals responsibility and foresight. It shows that a company understands its risk profile and has taken steps to mitigate it. This perception can influence everything from contract negotiations to investor confidence. In a competitive landscape, the ability to demonstrate preparedness is a strategic asset in its own right.

Technology has further enhanced the strategic dimension of insurance. Data analytics, predictive modeling, and digital platforms allow for more precise risk assessment and policy customization. Strategic thinkers leverage these tools to optimize coverage, reduce costs, and align insurance with broader objectives. For example, a logistics company might use real-time data to adjust its cargo insurance based on route risk. A homeowner might install smart sensors to qualify for premium discounts. These actions reflect a strategic mindset—one that uses information to make smarter, more adaptive decisions.

Ultimately, insurance is not just a financial transaction—it’s a strategic choice. It reflects a willingness to engage with uncertainty, to plan for contingencies, and to protect what matters most. It’s a tool that supports resilience, enables growth, and reinforces long-term thinking. Whether in personal life or business, those who embrace insurance as part of their strategic framework are better equipped to navigate complexity, seize opportunity, and build lasting success. In a world where change is constant and risk is unavoidable, insurance offers not just protection—but perspective. And that makes it one of the most quietly powerful expressions of strategic thinking available today.