The Different Types of Life Insurance and Which One Is Right for You

The Different Types of Life Insurance and Which One Is Right for You

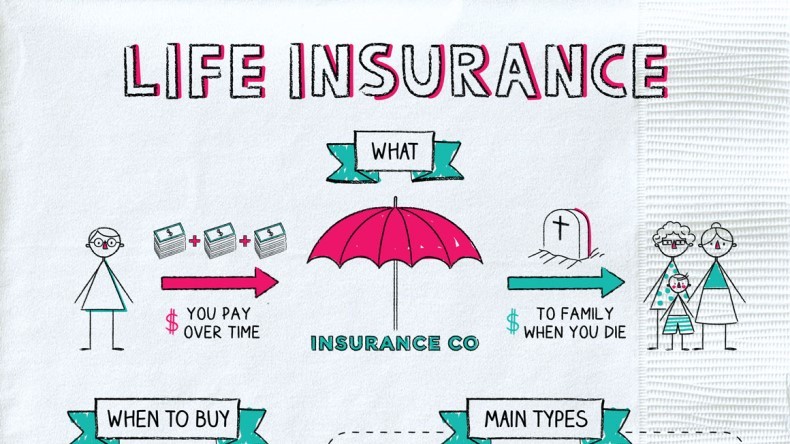

Embarking on the journey of securing life insurance is a profound act of care. It is rooted in the simple, powerful desire to provide financial security for your loved ones long after you are gone. Yet, for such a straightforward goal, the marketplace of insurance products can seem bewilderingly complex, filled with jargon and a wide array of options. The key to navigating this landscape with confidence is to understand that most products fall into a few core categories, each designed to meet different needs at different stages of life. The central decision often boils down to a fundamental choice: are you seeking pure protection for a specific period, or are you looking for lifelong coverage that also builds a financial asset over time?

The most accessible and straightforward form of life insurance is Term Life insurance. As its name suggests, this policy provides coverage for a specific term, such as 20 or 30 years, or until a certain age like 65. If the insured person passes away within this term, their beneficiaries receive the full death benefit payout. If you outlive the policy term, it simply expires, typically with no remaining value. The best analogy for term insurance is that of renting a home; you pay for the protection you need for the period you need it, but you do not build any equity. Its primary and most significant advantage is its affordability. For a relatively low premium, an individual can secure a very large amount of coverage, making it an incredibly efficient tool for protecting against specific, time-bound financial obligations.

In contrast to the temporary nature of term insurance stands Whole Life insurance, a form of permanent coverage. This policy is designed to cover you for your entire life, as long as the premiums are duly paid. A whole life policy has a dual function. It provides the guaranteed death benefit to your beneficiaries, and it simultaneously accumulates a “cash value” component. A portion of your premium contributes to this cash value, which grows over time, often at a guaranteed rate. This accumulated value can be accessed during your lifetime, either through a loan against the policy or by surrendering the policy for its cash value. Continuing the housing analogy, a whole life policy is akin to buying a property. Your mortgage payments provide you with shelter (protection), but you are also steadily building equity (cash value) that becomes a tangible asset. This dual-purpose nature means premiums for whole life insurance are substantially higher than for term insurance for the same initial death benefit.

A third prominent category, particularly popular in Singapore, is the Investment-Linked Policy, or ILP. Like whole life, an ILP offers a combination of insurance protection and an investment component. The key difference lies in how the value accumulates and who bears the risk. With an ILP, a portion of your premium is used to purchase units in investment funds of your choosing. The policy’s cash value, and in some cases the death benefit, will then fluctuate based on the market performance of these underlying funds. This structure offers the potential for higher returns compared to the more conservative, guaranteed growth of a traditional whole life plan. However, it also means the policyholder assumes the full investment risk. If the chosen funds perform poorly, the cash value could stagnate or even decline.

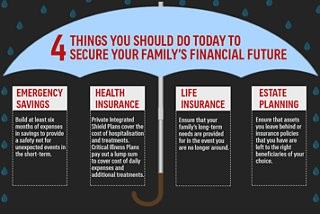

Deciding which of these options is right for you is less about the products themselves and more about your personal circumstances, financial goals, and life stage. For a young family with a new mortgage and young children, the most pressing need is to replace a large amount of future income on a limited budget. A comprehensive Term Life insurance policy is often the most logical and efficient solution to cover these responsibilities until the children are financially independent and the mortgage is paid down. As an individual progresses in their career and their income grows, their strategy might evolve. They may choose to supplement their term policy with a Whole Life plan to begin building cash value and lock in a level of permanent coverage for life.

For high-net-worth individuals or those approaching retirement, the focus often shifts from income replacement to legacy and estate planning. In this context, a Whole Life policy becomes a strategic tool. The guaranteed death benefit can provide immediate, tax-free liquidity to their heirs, which can be used to pay estate taxes, settle debts, or equalize inheritances among children without the need to sell off property or other assets in a hurry. An ILP, on the other hand, best suits those with a longer investment horizon and a higher risk tolerance who are comfortable with the hands-on nature of managing their policy’s underlying investments.

Ultimately, there is no single “best” type of life insurance. The right choice is deeply personal. It requires a clear-eyed assessment of your budget, your financial dependents, your long-term goals, and your comfort with risk. For many, the optimal solution is not an “either/or” decision but a thoughtful combination of policies that evolve as life changes. By understanding these fundamental differences, you can move forward with clarity, building a plan that provides true and lasting peace of mind.